In private investment strategies involving real assets, there is a common feature called a waterfall structure. The feature can be a rather complicated concept and therefore not well understood. This post will try to explain the concept with some hypothetical numbers.

What is a waterfall?

Waterfall is simply how distributable cash flows from an investment are prioritized and distributed between equity investors and the project sponsor (general partner) in a pre-determined hierarchy. It is a structure used to align the interests of both project sponsors and equity investors. It is an incentive structure used to motivate the deal sponsor to deliver more than the minimum returns to the investors. The more returns the investor gets, the more reward the sponsor also gets, and vice versa.

Key factors that influence a waterfall structure

How a waterfall is structured mostly depends on the project sponsor, deal structure, investment strategy, types of investors, investment, and investment hold period. For example, a buy and hold real estate investment strategy with at least a 3-5years hold period will typically have a waterfall structure with preferred returns because of the relatively low distributable operating cash flows before exit. Conversely, a fix and flip investment strategy, where an asset is purchased with 100% debt, renovated/repositioned, and sold almost immediately, will not have a waterfall structure.

Waterfall is commonly used in private investment vehicles and/or strategies like Real Estate Private Equity/Syndicates, Private Equity Funds, Venture Capital, Buyouts “LBO (leverage buy-out) or MBO (management buy-out)”, Growth Capital, Mezzanine Capital, Private Debts, or similar vehicles because they are long term oriented. We will explain the underlined strategies and terminologies in our future insights.

Key Waterfall Metrics

The most commonly used waterfall metrics are preferred return (“the Pref.”) and internal rate of return (IRR). Other metrics include multiple of invested capital (MOIC) typically referred to as equity multiple, percentage of capital returned within a certain period, hold period, etc. Preferred return is very common in real estate private equity deals, but is not synonymous with every private investment deal or strategy. It is common in real estate deals because of relatively low profits made over a long period before the asset sale and subsequent return of capital to investors. Once the total invested capital is returned and preferred returns paid to investors, the remaining profits are split between the sponsor and investor in a pre-determined proportion.

What is a preferred return?

Preferred Return is the initial and minimum compensation payable to equity investors for the equity risk taken in a project. It is the minimum annual return that the equity investors are entitled to and must receive before deal sponsors share in the profit. It is calculated as a percentage of the invested capital and is payable monthly, quarterly, bi-annual, or annually. It is typically calculated as simple interest or compounding interest on the invested capital and could be cumulative or non-cumulative.

Simple preferred return: returns are based on the initial invested amount only. Any unpaid portion of the annual preferred return amount will be accrued and paid the following year or whenever there is enough cash flow. No return will be earned on any accumulated unpaid preferred returns regardless of when they are paid.

Compounding preferred return: Unlike the simple preferred return, any unpaid preferred cash return in a given year will be added to the outstanding amount (initial invested capital plus any outstanding unpaid returns) due to the investors. The invested capital plus the outstanding unpaid preferred return becomes the new base on which the following year’s preferred return will be See the example below.

For investors that focus on total return, it does not really matter if the preferred return is simple, compounding cumulative, or non-cumulative provided there is an agreed pre-determined rate of return that the investors must achieve before a project sponsor can share in the profits. Investors that seek consistent cash flow at regular intervals favor cumulative compounding preferred return.

How does waterfall work?

Waterfall typically have predetermined returns (preferred return, IRR and/or MOIC, etc ) that the equity investors must achieve at each predetermined tier (hurdles) before the sponsor can share in the profit (“earn a Promote”). The simplest waterfall is a two-tier structure where once the investors achieve the agreed minimum return, the investors can then share the remaining profit with the sponsor in the predetermined proportion e.g 80-20, 70-30, 60-40, etc.

A three-tier waterfall structure is considered simple, less complicated, and more adequate to incentivize the sponsor and keep sponsor and investor interests aligned. The sponsor will only be entitled to share in the profit after the tier-one return has been achieved. The remaining profit after distribution of the tier-one return will be split between the investor and sponsor in a predetermined proportion until the investors achieve the agreed tier-two level hurdle. The residual profit after tier-two will be split between the investor and sponsor in a predetermined proportion.

Waterfall illustration with calculations

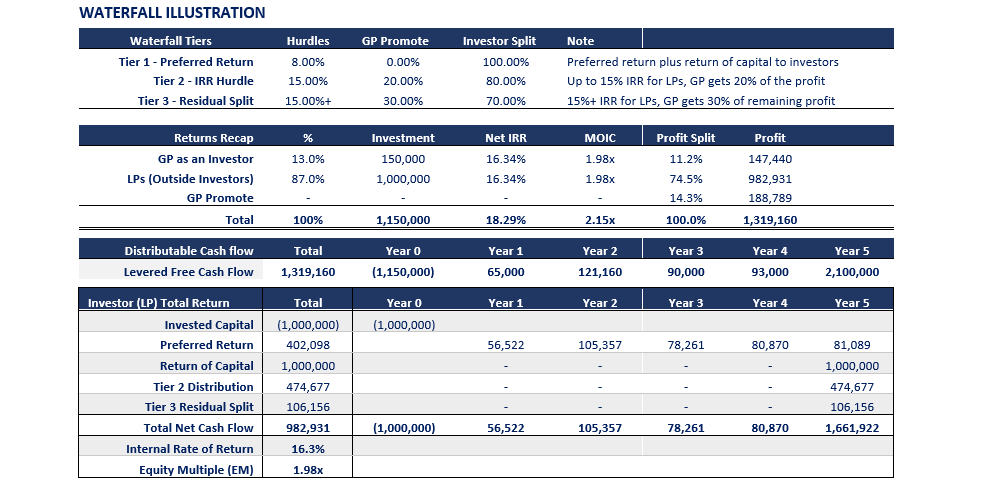

Let’s assume a five (5) year hold period real estate deal with a $1,150,000 equity investment of which LPs contributed $1,000,000 (87%) while the GP co-invested $150,000 (13% – skin in the game) in a three-tier waterfall structure.

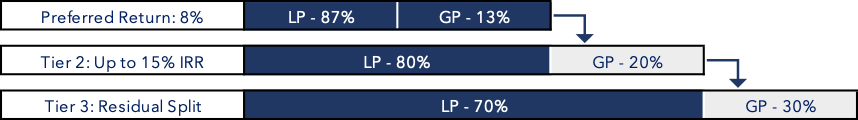

* Tier 1: Preferred Return – 8% per annum (cum-compound)

* Tier 2: Up to 15% IRR – LPs/Investors get 80% of the remaining profit, and GP gets 20% (promote)

* Tier 3: Residual Split (above 15% IRR) – LPs/Investors get 70% of residual profit, GP gets 30% (promote)

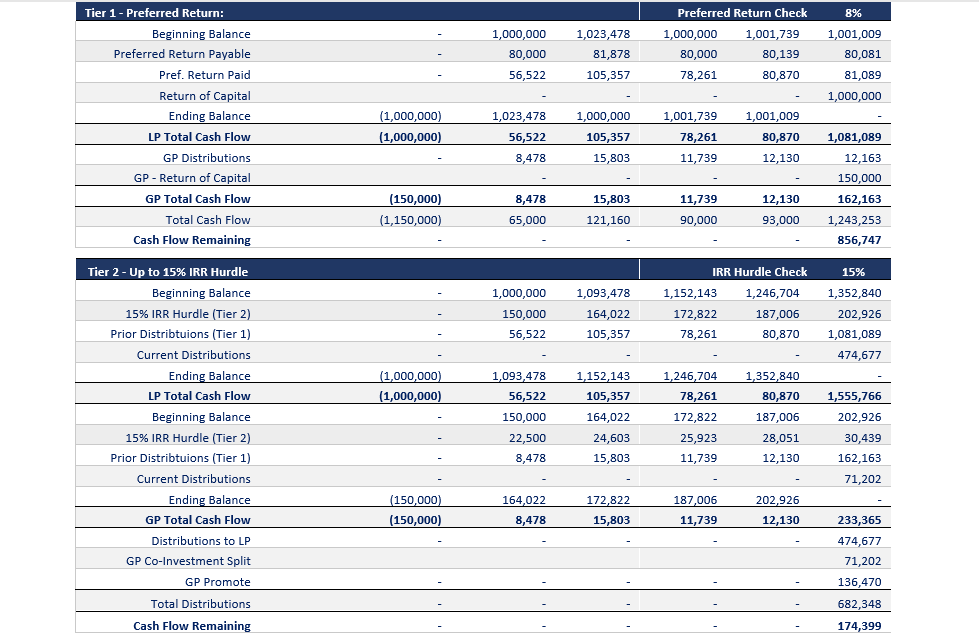

Tier 1: Preferred Return 8% (compounding) – All equity contributors (LPs & GP) will earn 8% on their invested capital per annum throughout the investment hold period. LPs should receive $80,000 (8% X $1,000,000) preferred return each year. In this example, however, the LPs will only receive $56,522 in year one due to lower operating cash flow. Because it is a compounding pref., the balance of $23,478 will be added to the LP invested capital to form the base for year two preferred return calculation. That means year two preferred return will be $81,878 based on $1,023,478 ($1000,000 + $80,000 earned – $56,522 paid). If at the end of year two, there was sufficient cash flow to pay both the $81,878 earned for the year and the $23,478 outstanding from year one, the base for calculating the preferred return for year three will reset to the initial capital contributed ($1,000,000) and so on. As a result of compounding, the LPs will receive a total preferred return of $402,978 instead of $400,000 as shown in the calculation summary below.

Tier 2: Up to 15% IRR – This tier triggers the disproportionate distribution of profits in favor of the GP as incentive and compensation for the unlimited liabilities risk taken, and operating the asset efficiently to deliver more than the preferred return to the investors. After the preferred return (8%) and return of capital have been achieved, the remaining profits will be split 80-20 between the investors (80%), and the sponsor (20%) until up to 15% IRR is achieved by the investors. The 15% IRR calculation includes the cumulative share of cash distributions from operations, refinance proceeds (if any), and asset sale proceeds. The actual distribution under tier-two is cumulative of the difference between the 15% hurdle amount payable on the investment balance each year and the tier-one preferred return (8%) paid. In effect, investors get an additional 7% cumulative compounding return. In this case, the investors get $545,878 ( LPs – $474,677 and GP – $71,202 ), and the GP gets a Promote of $136,470.

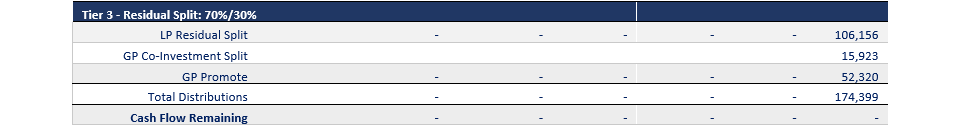

Tier 3: Residual Split (30:70) – After achieving the tier-two 15% IRR, any profit remaining is a residual split where the investors receive 70% – $122,079 while the sponsor/GP gets 30% Promote – $52,320.

Keep in mind the deal sponsors/promoters/GPs are not investors in every deal that they promote. In cases where a sponsor is not an investor in a deal, the sponsor will earn only carried interest/promote at the exit. This is why it is very important to separate returns that a sponsor earns as a co-investor in a deal from the carried interest/performance fee. As a co-investor, the sponsor’s investment return metrics (IRR, Equity Multiple etc) will be identical to the LPs’ because the terms of investment are typically the same. If the metrics are not identical, something is wrong.

You can download the Excel file for this Waterfall illustration below, and use it to analyze your deals. If you need clarification or any help with the model, reach out to us.